Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

Tonight at 21:30, the U.S. Bureau of Labor Statistics will release the January non-farm payroll report, along with annual benchmark revisions. The market expects only 70,000 new jobs to be added in January, with the unemployment rate holding steady at 4.4%. However, several economists predict the data could fall far short of expectations, potentially nearing zero growth, while the annual revisions might erase over a million jobs. The market is betting on the Fed cutting rates two to three times this year. Analysts note that if the non-farm data falls below expectations, the dollar will face pressure, and gold might find an opportunity to rally. Lee Ferridge, a strategist at State Street Bank, further pointed out that if Trump-nominated Kevin Warsh becomes the next Fed Chair, he might face pressure to cut rates in response to Trump's demand for lower borrowing costs, potentially leading to a rate cut magnitude in 2026 that exceeds market expectations, causing the dollar to fall 10% for the year. He also believes the Fed has room for a third rate cut.

In the precious metals market, David Meger, Head of Metal Trading at High Ridge Futures, views the pullback in gold prices as an event-driven consolidation, with geopolitical tensions and a weak dollar still supporting its long-term upward trend. The Silver Institute's report predicts that silver will face a supply shortfall for the sixth consecutive year in 2026. Although industrial demand is expected to drop by 2% due to reduced photovoltaic usage, physical investment demand is forecast to grow by 20%. Geopolitically, the U.S. government's discussion of seizing an Iranian oil tanker and the increased risk of Iran blocking the Strait of Hormuz have heightened market uncertainty. Additionally, Wall Street's anxiety over AI is spreading. From wealth management firms to the software industry, investors are shifting from seeking winners to avoiding potential losers. Technical analyst Trader Mayne even predicts the S&P 500 could fall by up to 20% in a worst-case scenario.

The Bitcoin market is searching for direction amidst short-term price volatility, with the price battling around the psychological and technical support level of $65,000 after breaking below a key channel. Analyst Murphy notes that this price level represents a more genuine "historical average turnover cost" after excluding long-dormant筹码 (chips/tokens). A break below this level could signal the market sliding from a "shallow bear" into a "deep bear" market. Cyril-DeFi considers the $65,000-$70,000 range a key support zone. If it fails to reclaim $72,000-$75,000, it faces a retracement towards the $60,000 liquidity level. CryptoReviewing also points out that the $66,000-$68,000 range has accumulated significant leveraged liquidity, which could become a target for liquidations. Analyst Tai Bai states that Bitcoin is approaching support levels at $66.5k, $64.5k, and $61.5k.

Regarding the market bottom, some analysts, like MN Capital founder Michaël van de Poppe and billionaire Bill Miller, believe $60,000 might already be the bottom of this correction cycle. Jelle notes that an RSI break below 37 typically signals a cycle bottom, potentially leading to a further drop to $52,000 or even $42,000. Kaiko Research suggests the current point might only be the "halfway point" of the bear market, with the historical magnitude of the correction indicating a bottom could be between $40,000 and $50,000. Sherlock warns of a possible retracement to $38,000-$40,000 based on the breakdown of the BTC/gold ratio. Roman推算 (calculates/reasons), based on an 80% decline from historical bear markets, that the bottom could be around $30,000-$35,000. Market maker Wintermute analysis suggests that although leverage has been liquidated, spot trading volume remains low, indicating insufficient market demand, and future price movements might be limited. In the short term, the market may remain volatile, needing to wait for key indicators such as ETF fund inflows, premiums turning positive, and basis rates stabilizing before a clearer upward trend can be seen.

Ethereum market confidence remains fragile, currently oscillating below $2,000. BitMine Chairman Tom Lee believes that if Ethereum can touch $1,890 again, it would form a "perfect bottom." He notes that the current price is very close to the bottom and is a time to look for opportunities rather than sell. MN Fund founder Michaël van de Poppe also believes that, based on valuation metrics like MVRV, Ethereum is in an excellent "buy the fear" window. On-chain data shows a surge in ETH withdrawals from exchanges, hinting at accumulation behavior in the $1,800 to $2,000 range. However, opposing views suggest the current recovery might just be the beginning of a larger basing phase. Based on price fractal analysis from 2021, the market might consolidate for months within a range of $1,300 to $2,000. Its MVRV Z-Score, while having entered the surrender zone at -0.42, has not yet reached the extreme levels seen at historical bear market bottoms.

2. Key Data (As of February 11, 13:00 HKT)

(Data Source: CoinAnk, Upbit, SoSoValue, CoinMarketCap)

-

Bitcoin: $67,056 (Year-to-date -23.43%), Daily Spot Trading Volume $45 Billion

-

Ethereum: $1,954 (Year-to-date -34.32%), Daily Spot Trading Volume $20.92 Billion

-

Fear & Greed Index: 11 (Extreme Fear)

-

Average GAS: BTC: 10.06 sat/vB, ETH: 0.35 Gwei

-

Market Dominance: BTC 58.9%, ETH 10.5%

-

Upbit 24-Hour Trading Volume Ranking: BTC, XRP, ETH, SONIC, ZRO

-

24-hour BTC Long/Short Ratio: 48.49% / 51.51%

-

Sector Performance: Crypto market maintains a downward trend, Meme sector leads decline over 4.5%

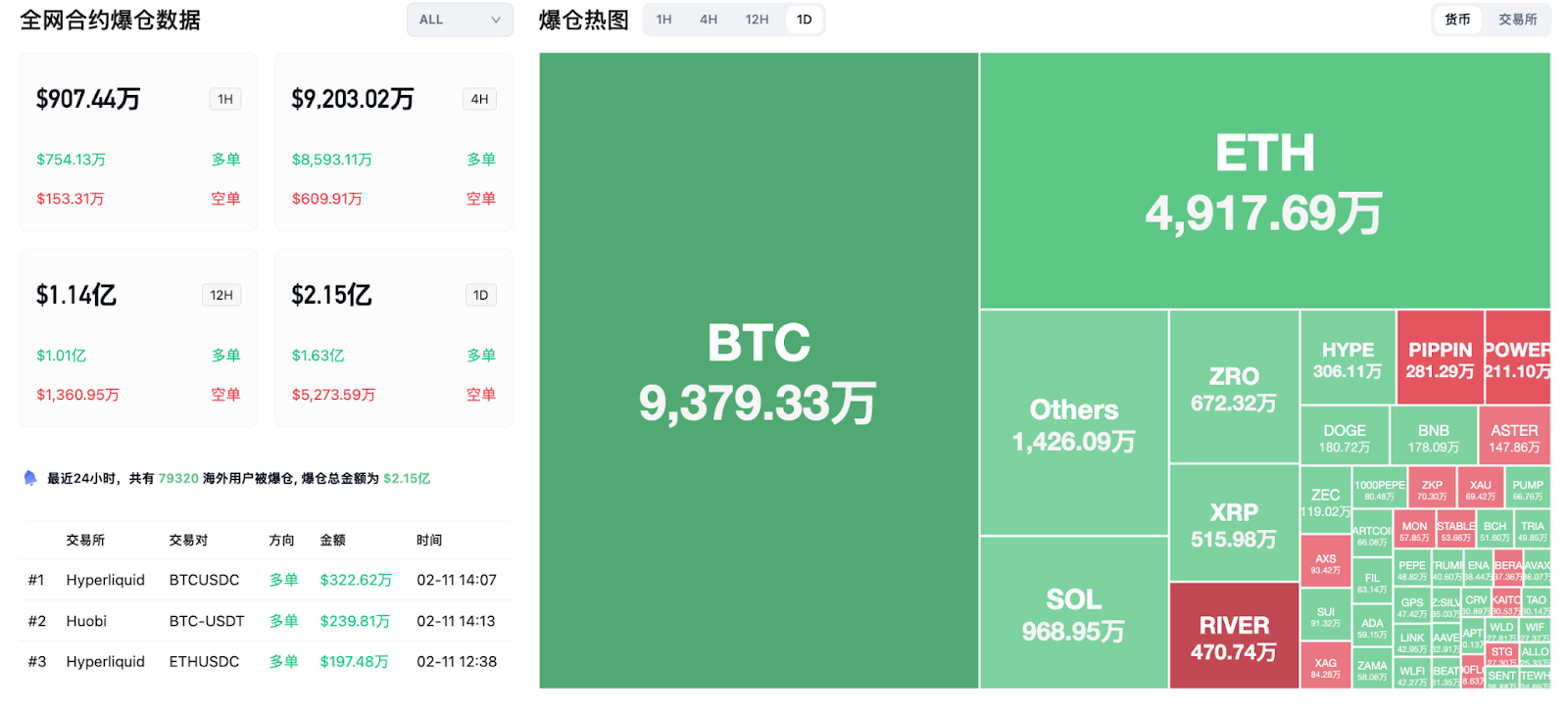

24-hour Liquidation Data: 79,320 people liquidated globally, Total liquidation amount $215 Million,其中 (of which) BTC liquidation $93.79 Million, ETH liquidation $49.1769 Million, SOL liquidation $9.6895 Million

3. ETF Flows (As of February 10)

-

Bitcoin ETF: +$167 Million, Net inflows for 3 consecutive days

-

Ethereum ETF: -$13.8184 Million, Grayscale ETH led with net inflows of $13.3173 Million

-

XRP ETF: + $3.2624 Million

-

SOL ETF: +$8.4305 Million

4. Today's Outlook

-

U.S. Department of Labor: Non-Farm Payrolls to be released on February 11, CPI data rescheduled to February 13

-

Binance Wallet launches Alpha blind box airdrop, first event starts February 11

-

Aztec TGE scheduled for February 12, ETH/AZTEC pool to be main price discovery source

-

Tokyo Stock Exchange closed (February 11)

-

US January Non-Farm Employment Change (10K): Expectation 65, Previous 50 (February 11, 21:30)

-

US January Unemployment Rate: Previous 4.4%, Expectation 4.4% (February 11, 21:30)

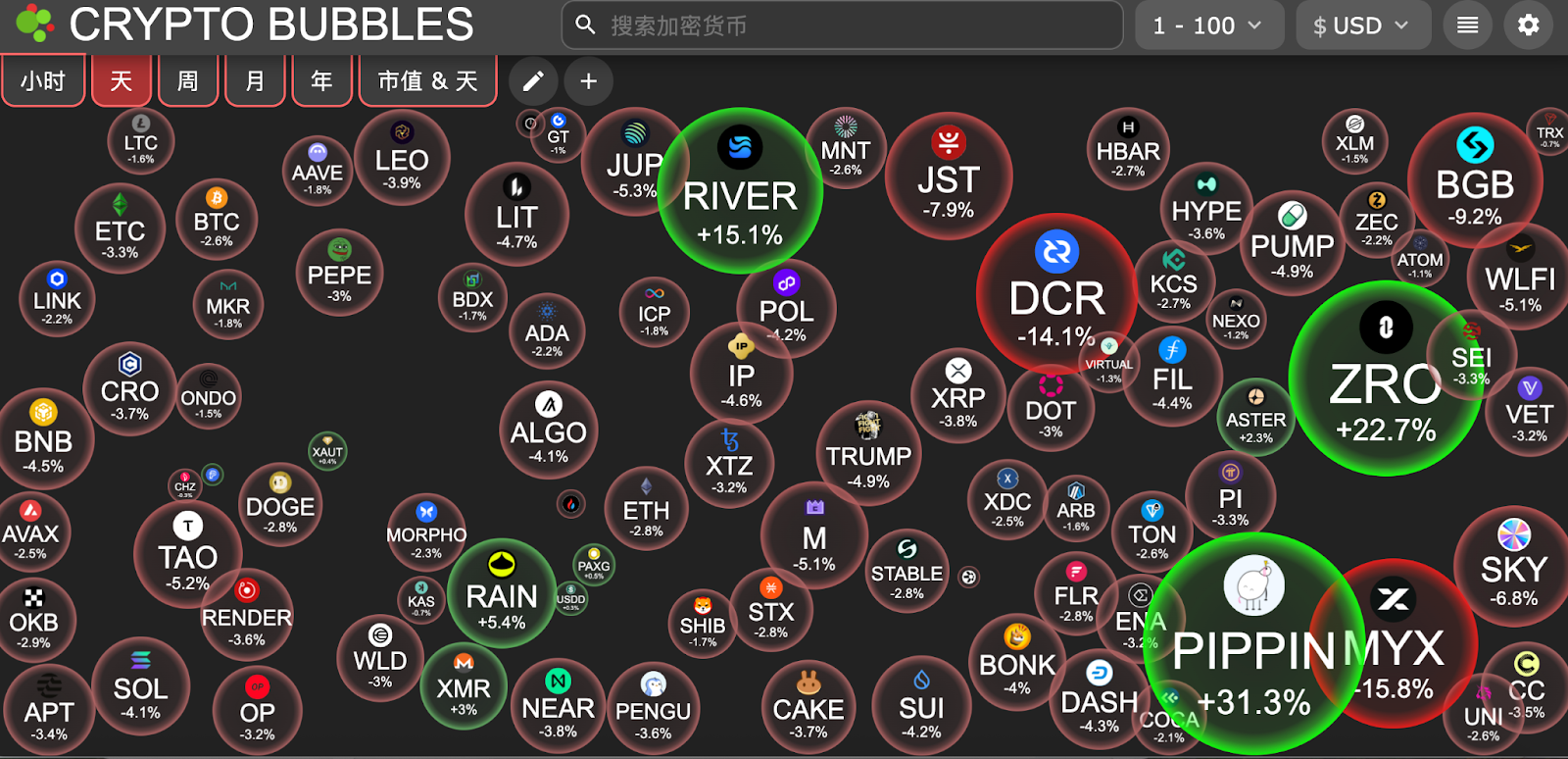

Today's Top Gainers (Top 100 by Market Cap): Pippin up 31.3%, LayerZero up 22.7%, River up 15.1%, Rain up 5.4%, Monero up 3%.

5. Hot News

-

Arkham: Trend Research's final loss on ETH this round was $869 Million

-

Largest ETH long whale on Hyperliquid adds 5,000 ETH long contracts

-

Goldman Sachs discloses indirect cryptocurrency holdings of $2.361 Billion via ETFs

-

Julia Leung announces three new measures for Hong Kong virtual asset regulation, including margin financing, perpetual contracts, etc.

-

Bitmine stakes over 140,000 ETH again 4 hours ago, approx. $282 Million

-

Robinhood stock falls after earnings report due to 38% drop in Q4 cryptocurrency revenue

-

LayerZero to launch new blockchain "Zero" for traditional finance, with Citadel, ICE, and Cathie Wood participating

-

A Hyperunit whale who once held over $10 Billion in BTC loses $250 Million longing ETH on Hyperliquid

-

EU plans comprehensive ban on crypto asset transactions with Russia to curb sanction evasion

-

Polymarket partners with Kaito AI to launch attention market based on social data